Assets under management of the Peruvian Pension Funds totaled USD 42.8 billion in March 2017. Even though a significant part of the funds is allocated to foreign investments near the regulatory limit, 40% out of 42%, from which 37% is invested in diversified mutual funds, Peruvian government bonds are still the preferred asset with USD 9 billion invested (21%).

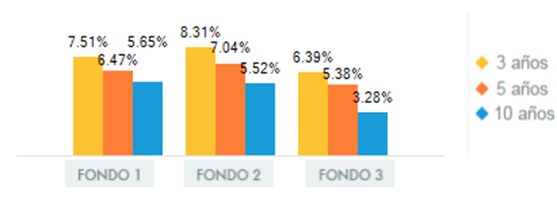

Annualized nominal returns calculated for the three types of funds managed shows the good performance each of them has had in the last three years in comparison to longer periods analyzed that is explained by the recently good performance of the stock markets.

A conservative strategy, represented by Fund 1, has outperformed the other two riskier funds for longer periods according to the bar chart (Updated June 2017 SBS).

Key variables (March 2017):

- 4 private pension fund managers

- - Affiliates: 6.4 million (38.5% of the Economically Active Population).

- - Contributors: 2.8 million (16.8% EAP).

- - Funds / GDP: 21%.

- - Pensioners: 168 thousand.

- - Average pension: 322 USD.

- - Dollarization: 50%